10GbVPS Review – Review Their VPS Hosting Services (2025 Updated)

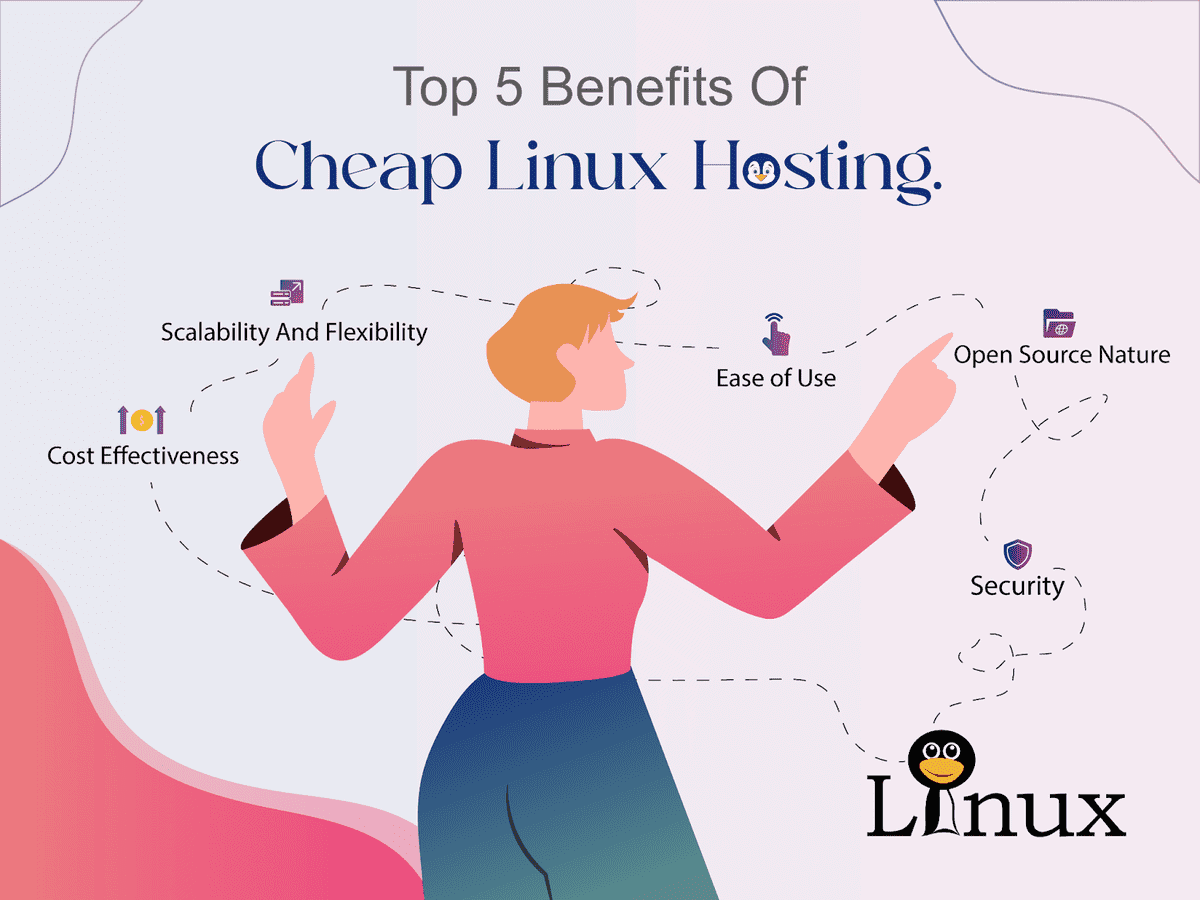

10GbVPS.com is a web hosting company that specializes in virtual private server (VPS) hosting. VPS hosting is a type of hosting service that provides users with a dedicated portion of a physical server’s resources. This gives users more control and flexibility than shared hosting, but it’s still more affordable than dedicated hosting. Benefits of VPS … Read more